All Categories

Featured

Table of Contents

When life quits, the dispossessed have no option but to keep relocating. Virtually quickly, households need to handle the challenging logistics of death complying with the loss of a liked one. This can include paying expenses, splitting assets, and managing the burial or cremation. While death, like tax obligations, is unpreventable, it does not have to burden those left behind.

In addition, a complete fatality benefit is often offered for accidental fatality. A customized death advantage returns premium frequently at 10% interest if death takes place in the first two years and entails the most relaxed underwriting.

To underwrite this company, firms count on individual health and wellness meetings or third-party information such as prescription histories, fraudulence checks, or automobile records. Financing tele-interviews and prescription histories can usually be utilized to assist the representative complete the application process. Historically companies depend on telephone interviews to validate or verify disclosure, but extra lately to enhance consumer experience, firms are relying upon the third-party information suggested over and giving split second choices at the point of sale without the meeting.

Funeral Expenses Insurance Companies

What is last cost insurance policy, and is it always the finest course ahead? Listed below, we take a look at how final expenditure insurance works and factors to take into consideration before you buy it.

While it is defined as a policy to cover last expenses, recipients who receive the fatality benefit are not required to utilize it to pay for last costs they can use it for any objective they such as. That's because final expense insurance coverage actually falls under the category of changed whole life insurance policy or streamlined problem life insurance policy, which are generally entire life plans with smaller fatality benefits, commonly in between $2,000 and $20,000.

Affiliate web links for the items on this web page are from companions that compensate us (see our advertiser disclosure with our listing of partners for even more information). Our viewpoints are our very own. See how we rank life insurance policy items to create objective product reviews. Interment insurance coverage is a life insurance policy policy that covers end-of-life costs.

Final Expense Project

Burial insurance coverage calls for no clinical exam, making it accessible to those with clinical problems. The loss of a liked one is emotional and stressful. Making funeral preparations and finding a means to spend for them while grieving adds one more layer of stress. This is where having funeral insurance, also called final cost insurance policy, can be found in handy.

Simplified concern life insurance coverage requires a wellness analysis. If your health and wellness status invalidates you from conventional life insurance, funeral insurance might be an alternative.

Compare affordable life insurance alternatives with Policygenius. Besides term and permanent life insurance policy, funeral insurance policy is available in numerous kinds. Have a look at your coverage choices for funeral costs. Guaranteed-issue life insurance has no wellness needs and uses quick authorization for protection, which can be valuable if you have severe, terminal, or multiple health conditions.

Nationwide Funeral Plans

Simplified concern life insurance policy doesn't require a clinical exam, but it does require a health and wellness questionnaire. This policy is best for those with moderate to moderate health problems, like high blood stress, diabetes mellitus, or bronchial asthma. If you do not want a medical examination but can receive a simplified issue plan, it is typically a better offer than an assured problem plan due to the fact that you can obtain even more protection for a less costly premium.

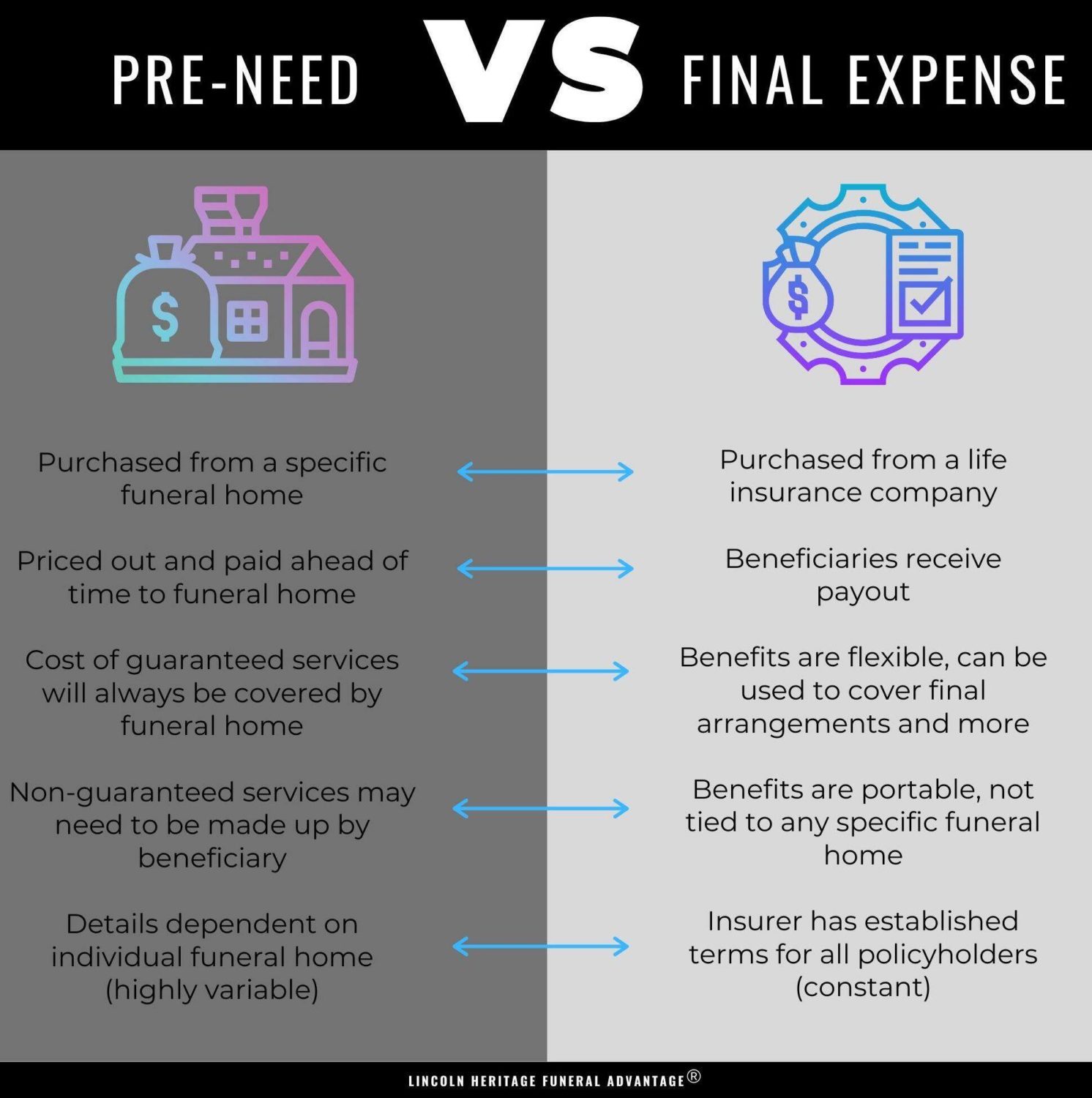

Pre-need insurance policy is high-risk since the beneficiary is the funeral home and coverage is certain to the chosen funeral chapel. Needs to the funeral chapel go out of company or you move out of state, you might not have insurance coverage, which beats the objective of pre-planning. Additionally, according to the AARP, the Funeral Service Consumers Alliance (FCA) advises against purchasing pre-need.

Those are essentially interment insurance plan. For ensured life insurance policy, costs calculations rely on your age, gender, where you live, and coverage quantity. Understand that insurance coverage amounts are restricted and differ by insurance policy supplier. We discovered example quotes for a 51-year-woman for $25,000 in coverage living in Illinois: You may determine to pull out of interment insurance if you can or have actually conserved up sufficient funds to repay your funeral and any kind of arrearage.

Burial insurance coverage provides a streamlined application for end-of-life insurance coverage. The majority of insurer require you to talk to an insurance agent to obtain a policy and acquire a quote. The insurance coverage representatives will certainly ask for your individual details, get in touch with info, monetary details, and insurance coverage preferences. If you determine to buy a guaranteed problem life plan, you won't need to undertake a medical test or survey.

The objective of living insurance coverage is to reduce the concern on your liked ones after your loss. If you have an additional funeral service plan, your loved ones can use the funeral plan to deal with last costs and obtain an instant dispensation from your life insurance policy to deal with the home loan and education and learning prices.

Individuals that are middle-aged or older with medical conditions may consider funeral insurance, as they could not get conventional plans with stricter approval criteria. In addition, interment insurance can be handy to those without extensive financial savings or standard life insurance policy coverage. Burial insurance coverage varies from various other kinds of insurance because it provides a reduced survivor benefit, usually just adequate to cover expenses for a funeral and various other associated expenses.

Free Burial Insurance

Information & World Report. ExperienceAlani has reviewed life insurance policy and pet insurer and has composed countless explainers on travel insurance policy, debt, financial obligation, and home insurance coverage. She is passionate about demystifying the intricacies of insurance coverage and other individual finance subjects to ensure that visitors have the details they require to make the ideal cash choices.

The even more coverage you get, the higher your premium will certainly be. Final expense life insurance policy has a number of benefits. Particularly, every person who applies can get approved, which is not the instance with various other types of life insurance policy. Final expenditure insurance coverage is commonly advised for senior citizens that may not receive typical life insurance coverage due to their age.

Additionally, final expense insurance policy is advantageous for people that intend to spend for their very own funeral. Funeral and cremation services can be expensive, so final expense insurance coverage offers assurance knowing that your liked ones will not have to use their cost savings to spend for your end-of-life plans. Last expenditure insurance coverage is not the best product for every person.

Final Expense Companies

You can have a look at Values' guide to insurance coverage at different ages if you need assistance deciding what kind of life insurance is best for your phase in life. Obtaining whole life insurance policy through Values fasts and simple. Protection is readily available for senior citizens between the ages of 66-85, and there's no medical examination needed.

Based on your responses, you'll see your approximated price and the amount of protection you get approved for (between $1,000-$30,000). You can acquire a plan online, and your coverage begins immediately after paying the first costs. Your rate never ever changes, and you are covered for your whole life time, if you continue making the regular monthly payments.

Ultimately, all of us need to consider exactly how we'll spend for an enjoyed one's, and even our very own, end-of-life expenses. When you market final expenditure insurance coverage, you can offer your clients with the assurance that features knowing they and their households are planned for the future. You can likewise acquire a possibility to maximize your publication of business and create a new revenue stream! Ready to find out whatever you require to recognize to start selling final expenditure insurance coverage successfully? Nobody suches as to think of their own death, yet the fact of the issue is funerals and funerals aren't low-cost.

Furthermore, clients for this kind of strategy could have extreme legal or criminal histories. It is essential to keep in mind that various service providers use a range of problem ages on their guaranteed issue policies as reduced as age 40 or as high as age 80. Some will likewise use higher face worths, as much as $40,000, and others will certainly permit far better survivor benefit conditions by improving the rate of interest with the return of premium or decreasing the variety of years until a complete death benefit is readily available.

Latest Posts

Number One Final Expense Company

Can You Make Money Selling Final Expense Insurance

What Is Final Expense Life Insurance